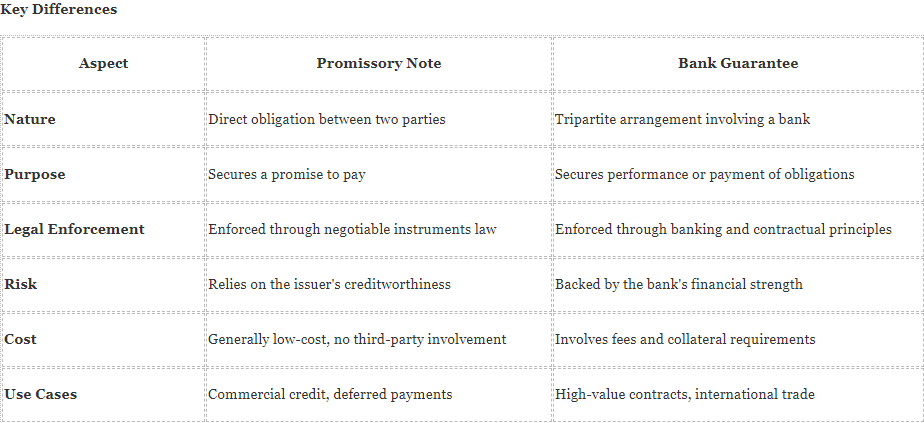

As Saudi Arabia continues to position itself as a global hub for trade and investment, the use of financial instruments to secure obligations has become an integral part of commercial transactions. Among the most utilized tools are Promissory Notes and Bank Guarantees. Both instruments serve distinct purposes, yet they differ fundamentally in terms of legal structure, enforcement, and practical application.

Promissory Notes

A promissory note represents a unilateral, written commitment by the issuer (maker) to pay a specified amount to the holder (payee) at a predetermined future date. In Saudi Arabia, these instruments are governed by the Negotiable Instruments Law and are recognized as enforceable financial instruments under the Enforcement Law.

Therefore a promissory note establishes a direct, unconditional obligation between two parties, with no involvement of intermediaries. This simplicity makes it a cost-effective tool for financial arrangements.

Under Saudi law, promissory notes can be enforced through specialized enforcement courts, offering an expedited recovery process. The holder is not required to pursue standard litigation, provided the note is properly drafted and complies with statutory requirements and the promissory note in order to be valid shall not be notarized.

When is the Promissory Note used?

• To secure deferred payments in commercial contracts;

• To create an evidence of private or corporate loans;

• To serve as collateral in smaller-scale transactions.

What are the risks?

The enforceability of a promissory note hinges on the financial solvency of the issuer. Unlike instruments backed by third parties, such as bank guarantees, the holder bears the full risk of non-performance if the issuer defaults.

Bank Guarantees:

A bank guarantee is a binding commitment issued by a financial institution to indemnify the beneficiary in case the principal debtor (applicant) fails to fulfill contractual obligations. In Saudi Arabia, bank guarantees are governed by the Banking Control Law under the supervision of the Saudi Central Bank (SAMA) and are often influenced by international standards, such as the Uniform Rules for Demand Guarantees (URDG 758).

What are the main characteristics?

• Unlike promissory notes, bank guarantees involve the participation of a bank, which assumes liability if the applicant defaults. This significantly reduces the risk for the beneficiary.

• Beneficiaries of bank guarantees benefit from a high degree of assurance, as the financial institution’s backing ensures that the obligations will be met. Enforcement typically involves a straightforward demand process, provided that the terms of the guarantee have been satisfied.

When is the Bank Guarantee used?

• To secure performance obligations in construction and infrastructure projects.

• To ensure payment obligations in international trade agreements.

• To provide financial assurance in government tenders and large-scale contracts.

What are the costs?

While bank guarantees provide unparalleled security, they come at a cost. Applicants are typically required to pay fees and may need to provide collateral, which can restrict liquidity.

Both promissory notes and bank guarantees are powerful financial instruments when properly utilized. However, their effectiveness depends on meticulous drafting, compliance with Saudi legal requirements, and the specific circumstances of the transaction. Legal consultation is essential to ensure that these instruments are tailored to the needs of the parties and provide the intended level of protection.

As a legal consultant with expertise in Saudi financial law, we emphasize the importance of understanding not only the technical distinctions between these instruments but also their practical implications in the Kingdom’s dynamic legal and commercial environment. For businesses operating in Saudi Arabia, selecting the appropriate instrument can mitigate risks and facilitate successful transactions in both domestic and international markets.

Thomas Paoletti

Francesca Romana Valeri